According to FNB , those who have 18 to 25 of age believe that they will start to save for retirement at 36 marketing an even later start

FNB have said that, “Only respondents who are affluent and wealthy are likely to maintain their current lifestyle in retirement. In addition, it also established that the respondents who are of retirement age only started saving for retirement at an average age that is above 30 years, arguably late by industry benchmarks”.

FNB reported that 74% of respondents claims they have a plan in place to help them prepare for retirement. 45% of respondents said that they have a retirement annuity.

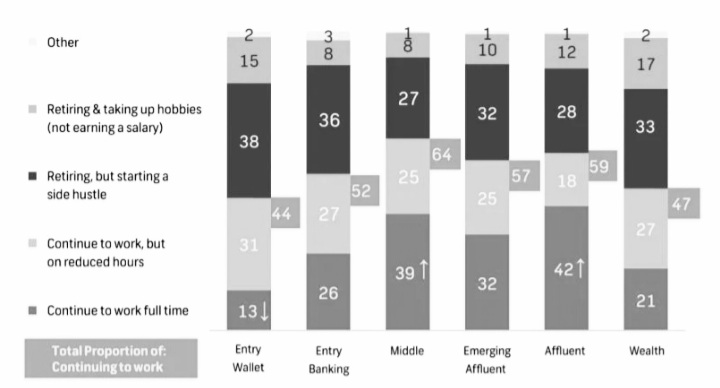

The bank reported that 44% of lower income respondents anticipate continuing to work while significant percentage of middle income and affluent participants, 64% and 59% respectively, expect to continue working either full time or on reduced hours.

Respondents in lower income brackets are not confident that their plan will deliver the result they want due to barriers such as age and current financial strain such as the heightened cost of living.

The FNB also said that “This appears to be corroborated by the fact that 39% (percent) of respondents who Don’t currently have a retirement plan in place will on alternative income sources for retirement, such as selling assets, family support, or Government social grants”.

Sizwe Nxedlana, the CEO of FNB private Segment, said that “Costumers need better education to help themse save better for retirement and for there to be a better saving culture in South Africa, even in light of volatile economy conditions.

“It was concerning that statistics point to a large portion of respondents who have not planned for retirement, saying that they may rely on social grants as part of their retirement”. Said by the CEO of FNB personal Segment, Lytania Johnson.